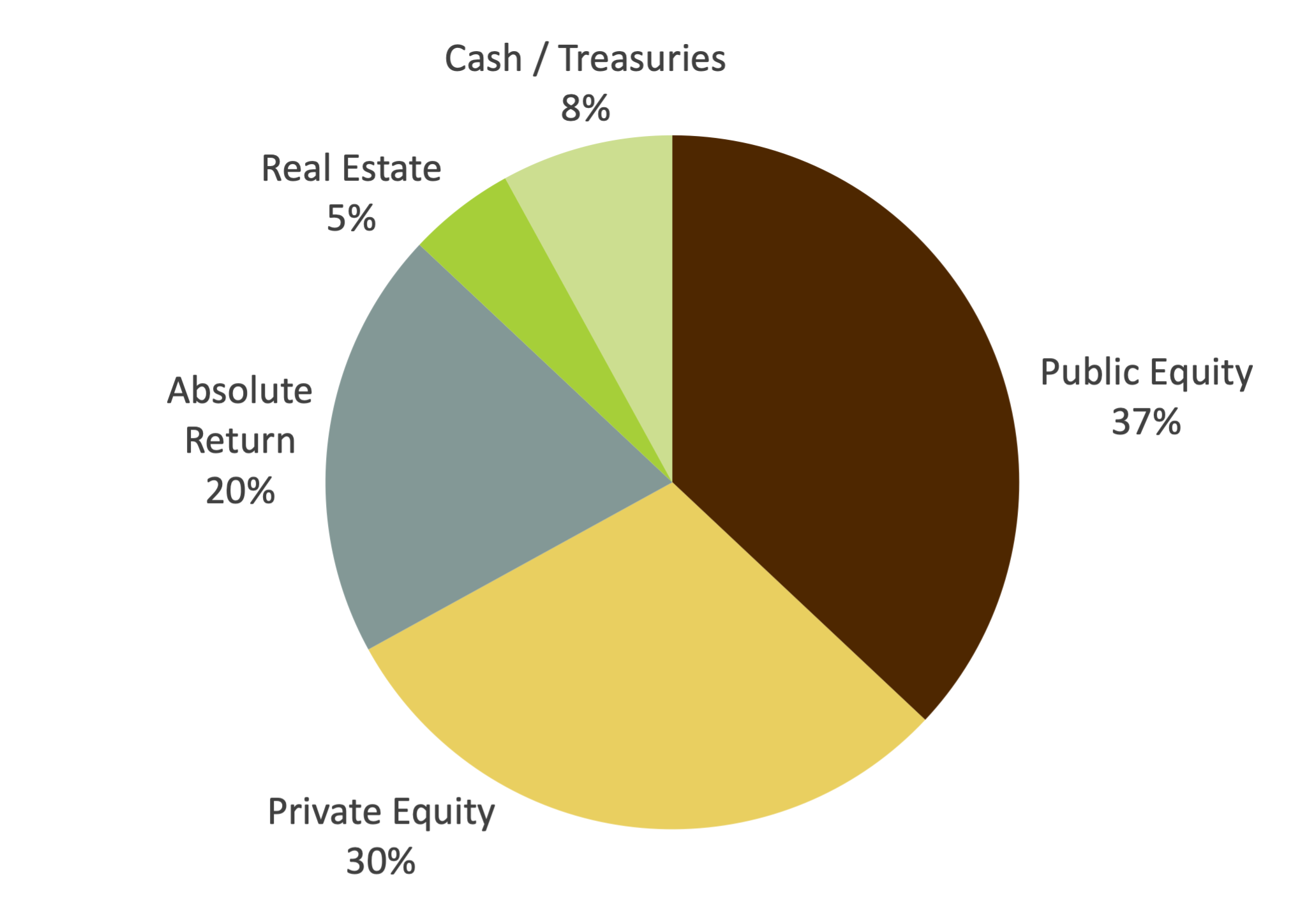

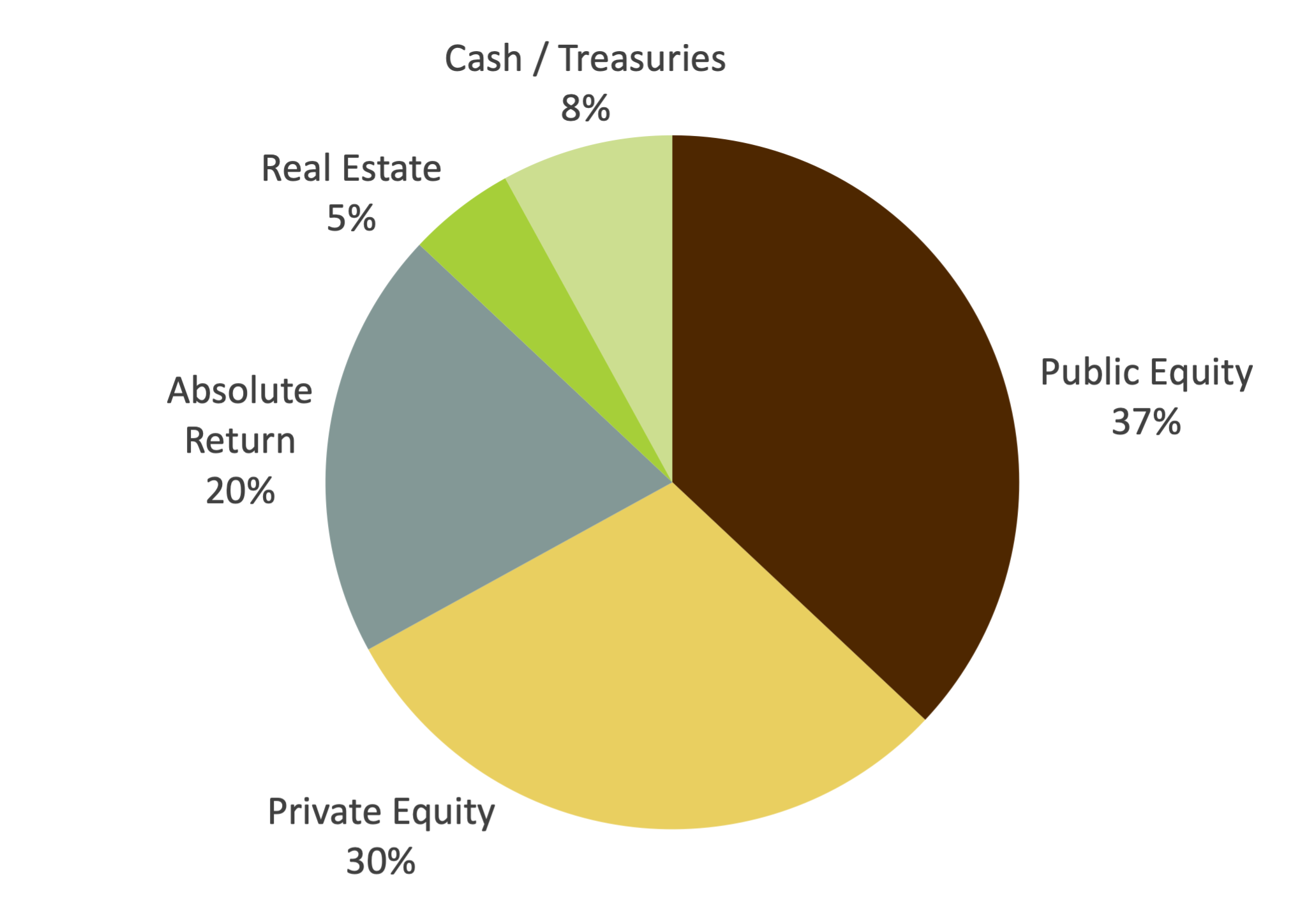

Lehigh Target Asset Allocation

Asset allocation is generally the primary driver of investment returns and risk over time; therefore, asset allocation policy is of central importance to the Endowment. The development of an asset allocation policy must incorporate a thoughtful understanding of the University's financial needs, goals, and willingness and ability to assume risk in pursuit of growth.

The asset allocation review process begins with an enterprise review of the University, looking at the University from a holistic standpoint. This holistic perspective is the basis for determining an appropriate level of risk and return for Lehigh to pursue in its investments. The process is a collaborative effort involving the leadership of both the University's administration and the Board of Trustees. The most recent review affirmed that Lehigh enjoys a healthy financial position and a strong credit rating; therefore, by taking on appropriate levels of risk Lehigh has the ability to pursue an investment program with a strong growth orientation.

Philosophy underlying Lehigh's Asset Allocation Policy: