From drinking a Dr. Pepper to Skyping with a friend or co-worker, from buying office supplies at Staples or popping Duracell batteries in the remote, private equity firms play a role in people’s daily lives, says Laura Katz Olson.

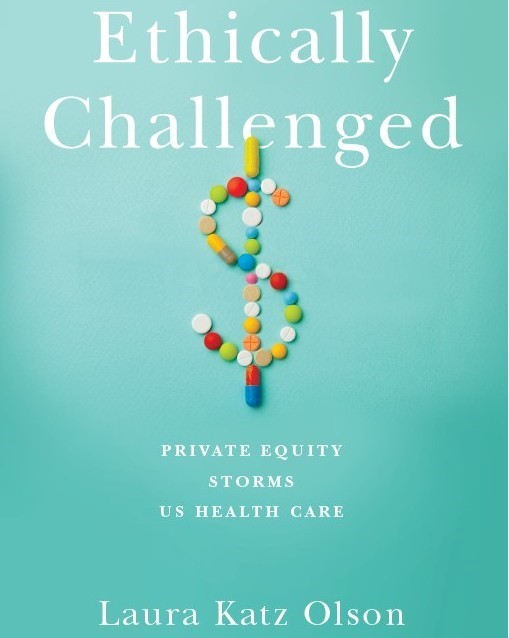

Private equity firms—investment firms which use other people’s money to buy other companies—are entrenched in nearly every industry, says Olson, Distinguished Professor of Political Science. However, not much is written about private equity and its impact on the United States’ health care system. Olson, who has studied health care and elder care throughout her career, investigates private equity’s impact in her newest book, “Ethically Challenged: Private Equity Storms US Health Care,” which has won two gold medals: one from the 2022 North American Book Awards and another from the 2023 Axiom Best Business Book Awards.

Olson first details a brief history of private equity firms, explaining the “destruction” caused in the 1980s when private equity bought big conglomerates and separated them because the parts were worth more than the whole. As a result, some went bankrupt.

Private equity’s “playbook,” Olson says, has a single goal: to make outsized profits. Using rarely more than 2% of their own money, private equity firms typically invest with money from public pension funds, wealthy individuals and university endowments, she explains. The rest is funded mostly by junk bonds, low-rated bonds issued by banks and lately private equity firms themselves, that feature a high rate of return, but also a higher rate of default than other bonds. Without the outsized profits, investors would rather have their money in the stock market, which they see as less risky.